Understanding the Rule of 72 is a simple yet powerful way to grasp the concept of compound interest and how it affects the growth of investments over time. At its core, the Rule of 72 is a mental math shortcut that helps estimate how long it will take for an investment to double, given a fixed annual rate of return. The formula is straightforward: divide 72 by the interest rate, and the result is the approximate number of years it will take for your money to double. While it’s not precise to the decimal, it’s remarkably accurate for rates between six and ten percent, making it a useful tool for financial planning and decision-making.

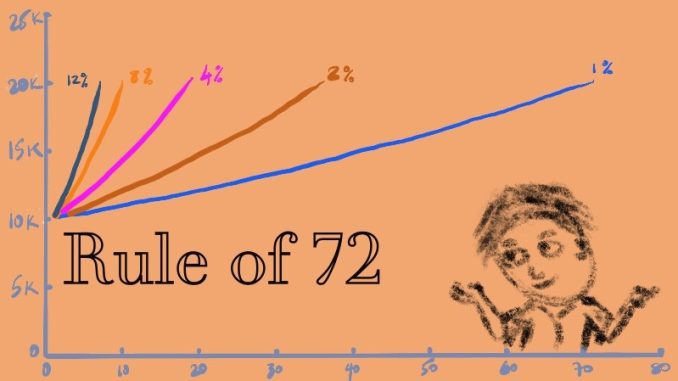

To appreciate the value of this rule, it helps to understand the mechanics of compound interest. Unlike simple interest, which is calculated only on the principal amount, compound interest grows exponentially because it includes interest earned on both the original investment and the accumulated interest from previous periods. This compounding effect accelerates growth over time, and the Rule of 72 offers a quick way to visualize that acceleration. For example, if you invest in a fund that yields an annual return of 8 percent, dividing 72 by 8 gives you nine years. That means your initial investment will roughly double in nine years, assuming the rate remains constant.

This kind of estimation is particularly useful when comparing investment options or evaluating the long-term impact of financial decisions. Suppose you’re considering two different savings accounts—one offering a 4 percent return and another offering 6 percent. Using the Rule of 72, the first account would double your money in 18 years, while the second would do so in 12. That six-year difference can be significant, especially when planning for retirement, education funds, or other long-term goals. It helps frame the importance of even modest differences in interest rates and encourages a more strategic approach to saving and investing.

The Rule of 72 also serves as a reminder of the cost of inflation. Just as it can be used to estimate how quickly investments grow, it can also show how quickly purchasing power erodes. If inflation averages 3 percent annually, dividing 72 by 3 suggests that the value of money will halve in 24 years. This perspective underscores the importance of choosing investments that outpace inflation, especially for those relying on fixed income or long-term savings. It’s not just about growing wealth—it’s about preserving it in real terms.

While the Rule of 72 is a handy tool, it’s important to recognize its limitations. It assumes a constant rate of return, which is rarely the case in real-world markets. Investment returns fluctuate, and compounding may not occur annually. Additionally, the rule becomes less accurate at very high or very low interest rates. For instance, at a 1 percent return, the rule suggests it would take 72 years to double your money, but the actual figure is closer to 70. Conversely, at a 20 percent return, the rule estimates 3.6 years, while the actual doubling time is slightly shorter. Despite these nuances, the rule remains a valuable approximation for everyday financial planning.

In business contexts, the Rule of 72 can be used to evaluate the growth potential of retained earnings, reinvested profits, or even customer acquisition strategies. If a company is growing its revenue at a steady rate of 10 percent annually, the rule suggests that revenue will double in just over seven years. This kind of insight can inform strategic decisions, from expansion planning to resource allocation. It’s a way to translate abstract growth rates into tangible timelines, making financial projections more relatable and actionable.

Educators and financial advisors often use the Rule of 72 to introduce clients and students to the concept of exponential growth. It’s a gateway to deeper understanding, sparking curiosity about how money works and why early investing matters. For younger investors, seeing how a modest rate of return compounds over decades can be a powerful motivator. It shifts the focus from short-term gains to long-term strategy and reinforces the value of patience and consistency in wealth building.

Ultimately, the Rule of 72 is more than just a formula—it’s a mindset. It encourages people to think in terms of time and growth, to evaluate opportunities with a long-term lens, and to appreciate the subtle power of compounding. Whether you’re managing personal finances, running a business, or advising clients, this simple rule can serve as a compass, guiding decisions and illuminating the path to financial success. It’s a reminder that time is one of the most valuable assets in finance, and when paired with smart investing, it can yield remarkable results.